|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

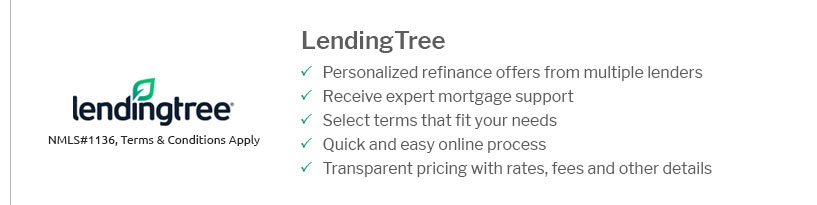

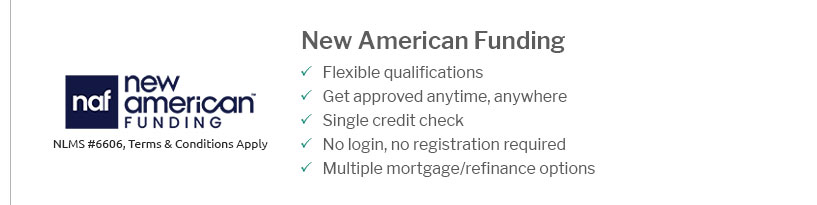

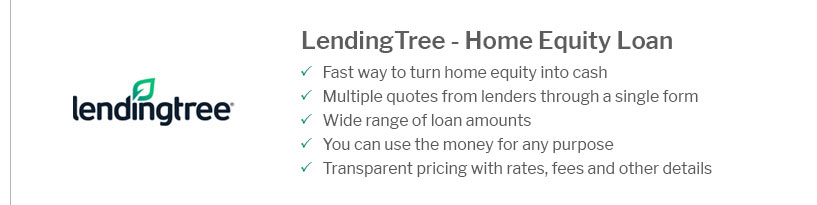

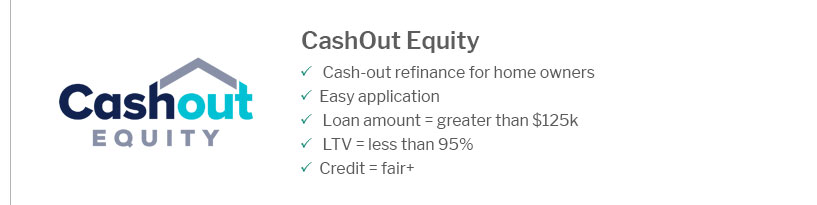

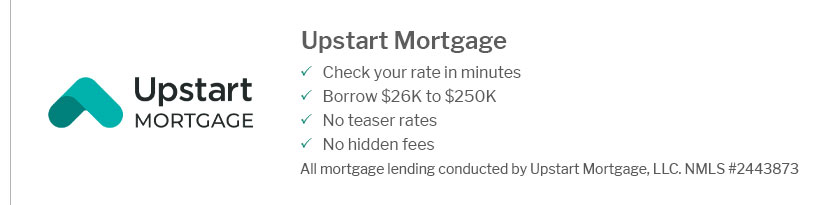

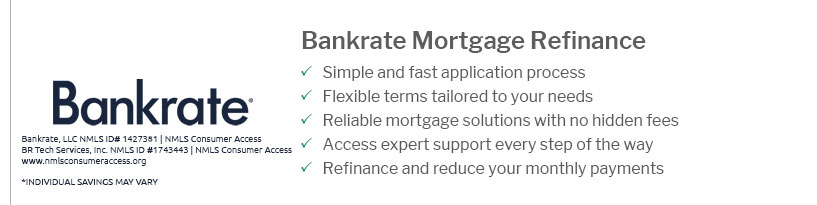

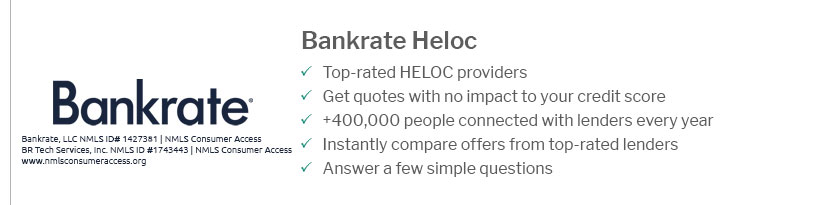

Top Rated Banks for Refinancing: A Comprehensive GuideRefinancing can be a smart financial move for many homeowners. Choosing the right bank to refinance with is crucial to maximize your savings and benefits. In this guide, we will explore some of the top-rated banks for refinancing, highlight their unique features, and offer practical advice to help you make an informed decision. Why Consider Refinancing?Refinancing your mortgage can lead to several benefits, including lower interest rates, reduced monthly payments, and even shortening the loan term. It's essential to assess your current financial situation to determine if refinancing is a suitable option for you. Lower Interest RatesOne of the primary reasons homeowners consider refinancing is to take advantage of lower interest rates. A reduced rate can significantly decrease the overall cost of your loan. Change Loan TermsRefinancing also allows you to modify the terms of your mortgage, such as moving from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage or vice versa. Top Banks for Refinancing

Each of these banks has its strengths. For instance, if you're seeking a 5 mortgage deals, exploring Bank of America's offerings might be beneficial. Factors to Consider When Choosing a BankBefore deciding on a bank, consider the following factors to ensure you select the best option for your refinancing needs. Interest Rates and FeesCompare the interest rates and associated fees of different banks. Even a slight difference in rates can lead to significant savings over the life of the loan. Customer ServiceGood customer service can make the refinancing process smoother. Look for banks with positive customer reviews and responsive service. Frequently Asked Questions

In conclusion, refinancing can be an effective strategy for saving money and achieving your financial goals. By carefully evaluating your options and considering the factors mentioned above, you can choose the best bank for your refinancing needs. https://www.bankrate.com/mortgages/best-lenders/refinance-mortgage-lenders/

Best mortgage refinance lenders in 2025 - Chase - Bank of America - Better - Navy Federal Credit Union - PenFed Credit Union - PNC Bank - SoFi. https://www.cnbc.com/select/best-mortgage-refinance-lenders/

Best for low rates: Better - Best for online tools: Magnolia Bank - Best for speedy closing: Rocket Mortgage - Best for availability: PNC Bank - Best credit union: ...

|

|---|